Back to Insights

Why is Collaboration Key to Improving ESG Data for Underwriting?

Quality data is critical to underwriting performance, and the industry collects plenty of it already. Similarly, talk about ESG is ubiquitous, and the need to incorporate ESG factors into underwriting and investment decisions alike is widely recognised. But how well do these two trends intersect in the Lloyd’s market?

The LMA’s Sustainability Committee has been investigating the problem in detail. In December 2022, we surveyed all the Heads of Sustainability and ESG Leads in the Lloyd’s market to find out how they are collecting and processing third-party ESG data. The results show clearly that the incorporation of such data into investment decision-making is relatively common. However, its use in underwriting is early in its development, in part because data providers are not yet meeting underwriters’ detailed needs.

Our survey aimed to determine how external ESG scoring data sets are used, and how widely. The response rate – just half of surveyed managing agents answered – is much lower than usual for LMA research of this type. The low response rate could indicate low levels of readiness to use such data, and although the evidence is far from conclusive, we can still draw a number of inferences. Crucially, it’s relatively unlikely that the 48% of managing agents that did not respond are more advanced in their usage of third-party ESG data than those that did respond, so we should be cautious about extrapolating survey responses to the entire market.

ESG datasets to inform investment

Of those that replied, 83% said they use external ESG datasets for investment purposes. However, the ways in which they use the data vary dramatically. At one end of the spectrum, some market participants use the data only for passive monitoring. At the other, third-party ESG data informs complex formulae intended to limit the ESG exposure of the investment portfolio overall, and even of investment classes within it. For investments, use is quite well embedded and often incorporated into investment appetite statements. The clear frontrunners for supply of data for investment information are MSCI and Sustainalytics.

ESG datasets to inform underwriting

The picture is very different when it comes to underwriting. Only 52% of respondents use external ESG data as part of underwriting decision makings. In most cases, the application of data to underwriting is in its very early stages or is used for information only. When it is used, it is only in certain lines of business, reducing the coverage even more. A handful of underwriting units have developed more complex processes for implementing third-party ESG data into underwriting portfolio management, although these approaches are even more rarely applied to individual underwriting decisions.

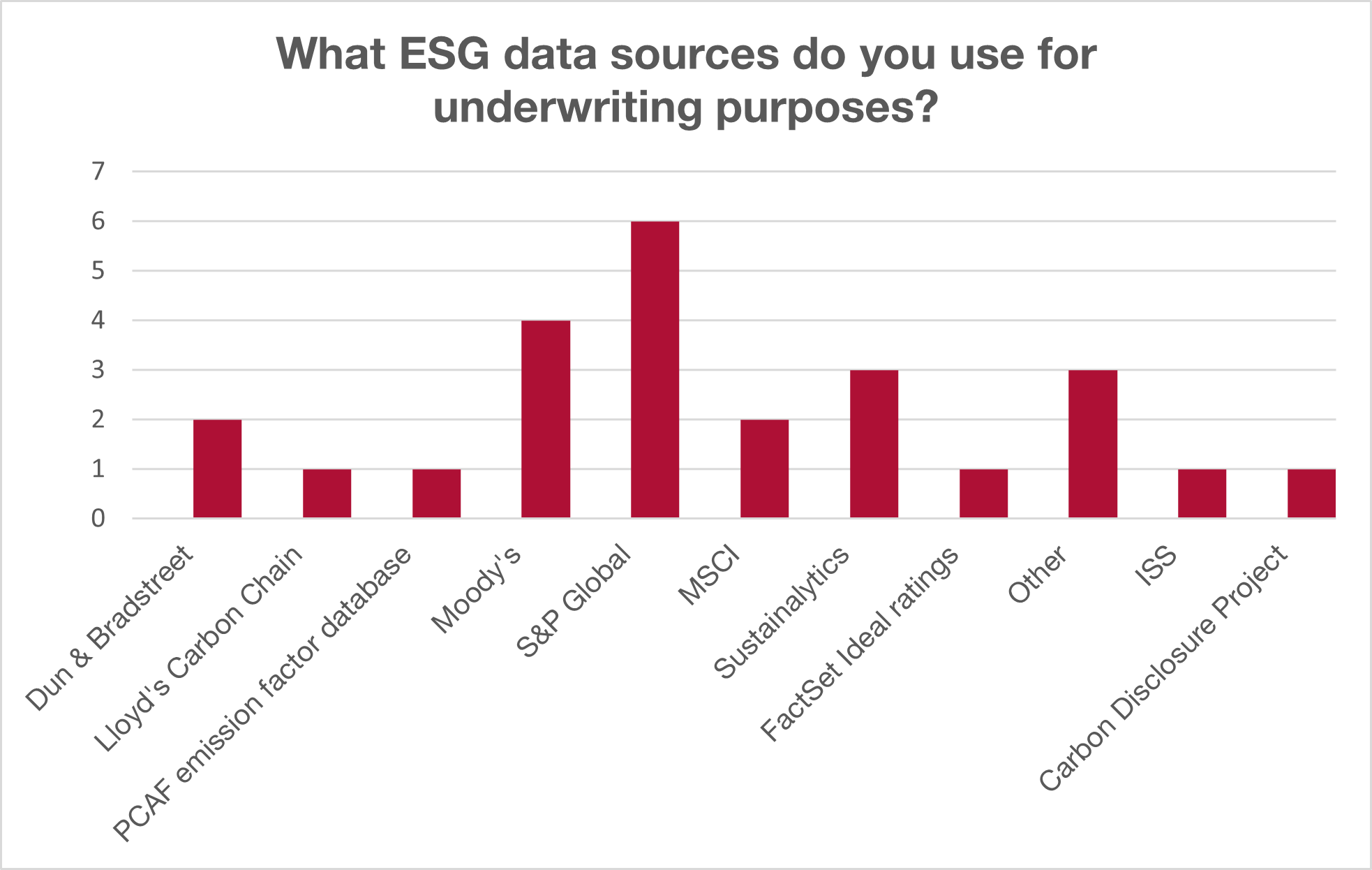

Meanwhile, the supply of data for underwriting is much more fragmented, with ten major and several minor suppliers named by respondents (Dun & Bradstreet, Lloyd's Carbon Chain, PCAF emission factor database, Moody's, S&P, MSCI, Sustainalytics, FactSet Ideal ratings, ISS and Carbon Disclosure Project) (see Figure 1). In this less-concentrated landscape, no clear frontrunners have emerged in the provision of data which underwriters consistently find valuable. That suggests an immature state both of supply and of usage.

ESG data granularity

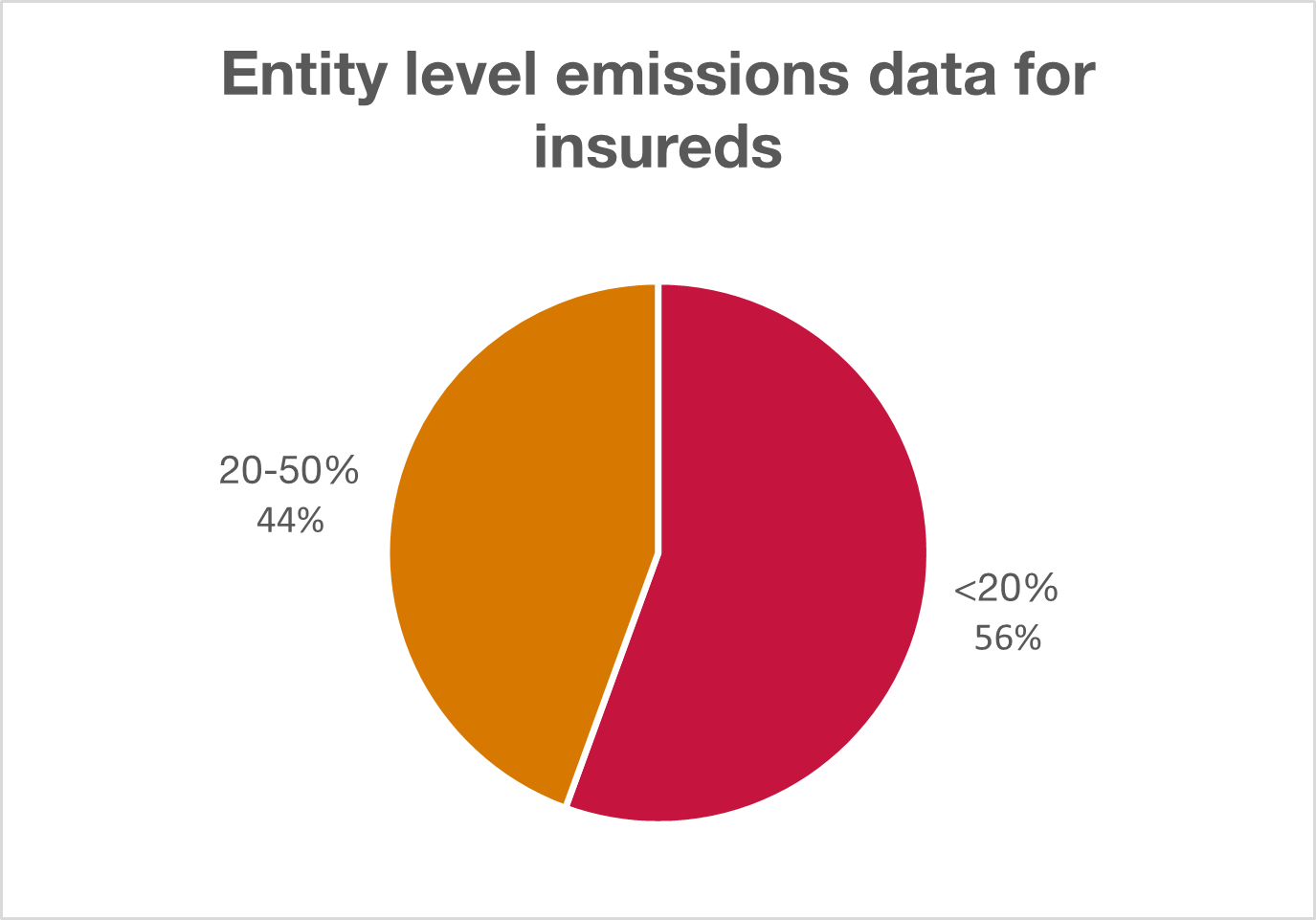

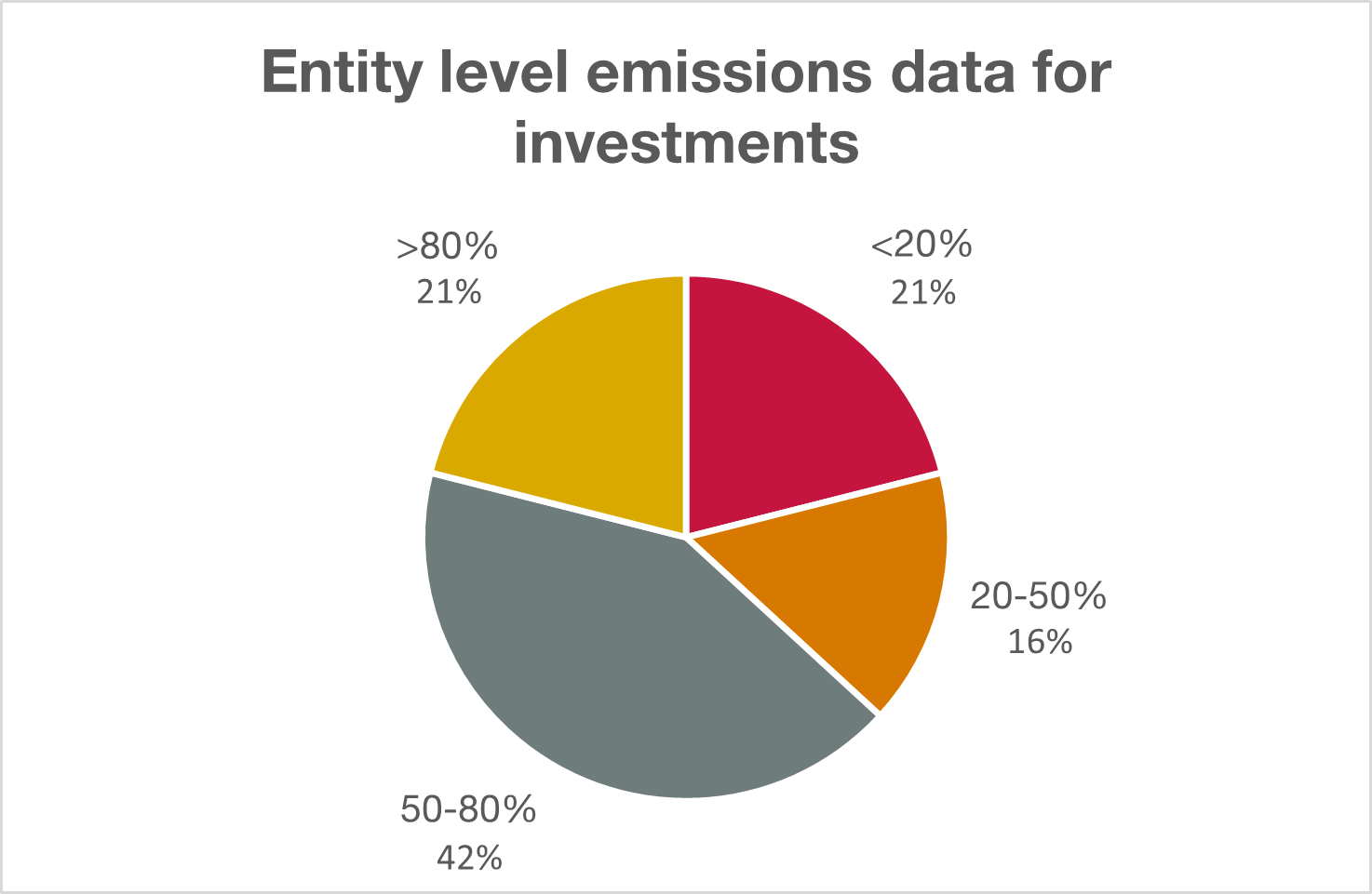

Granularity is key to the usefulness of ESG data for underwriting, which at minimum must be delivered at entity level. Often, to be fit for purpose for underwriters, it needs to be at asset or location level. The LMA’s research chose to focus on emissions data and compared the granularity of data used for investments to that deployed for underwriting.

Unsurprisingly, since most investments relate to listed companies with ESG disclosure requirements, entity-level emissions data is much more common for investment assets than for insured businesses. A fifth of respondents have such data for more than 80% of their investments, but none of them have this level of granularity for insured businesses, and 56% have entity level data for less than a fifth of their insureds (see Figures 2 and 3). If we infer that it is unlikely that those 48% of managing agents which did not respond have better data, it serves to further emphasise the gap in data availability for insureds versus investments.

The survey findings show clearly that underwriting firms need to define the data they want from suppliers (and ultimately from insureds) more clearly, and to understand better how they might use it. There is therefore an urgent need for deeper, independent research in individual classes of business, to better determine the relationship between ESG scores and insurance risk.

As a market, we are just at the beginning of understanding what ESG data we need, how to use it, and where it could come from. The LMA is well positioned to advance this agenda.

By bringing together resources, both commercial and academic, for research to collaborate with the market we will be better able to determine our data needs and work with data providers to improve the usefulness of the data they provide.

Since few doubt the long-term importance either of ESG or of data in underwriting, the time to act is now. The LMA have therefore set the furtherance of this agenda as a key priority for this year.