Back to Insights

Lloyd's 2024 Insights Report

The Lloyd’s Market Association (LMA) and Insurance Capital Markets Research (ICMR) are pleased to present a detailed analysis and comment on the Lloyd's 2023 results.

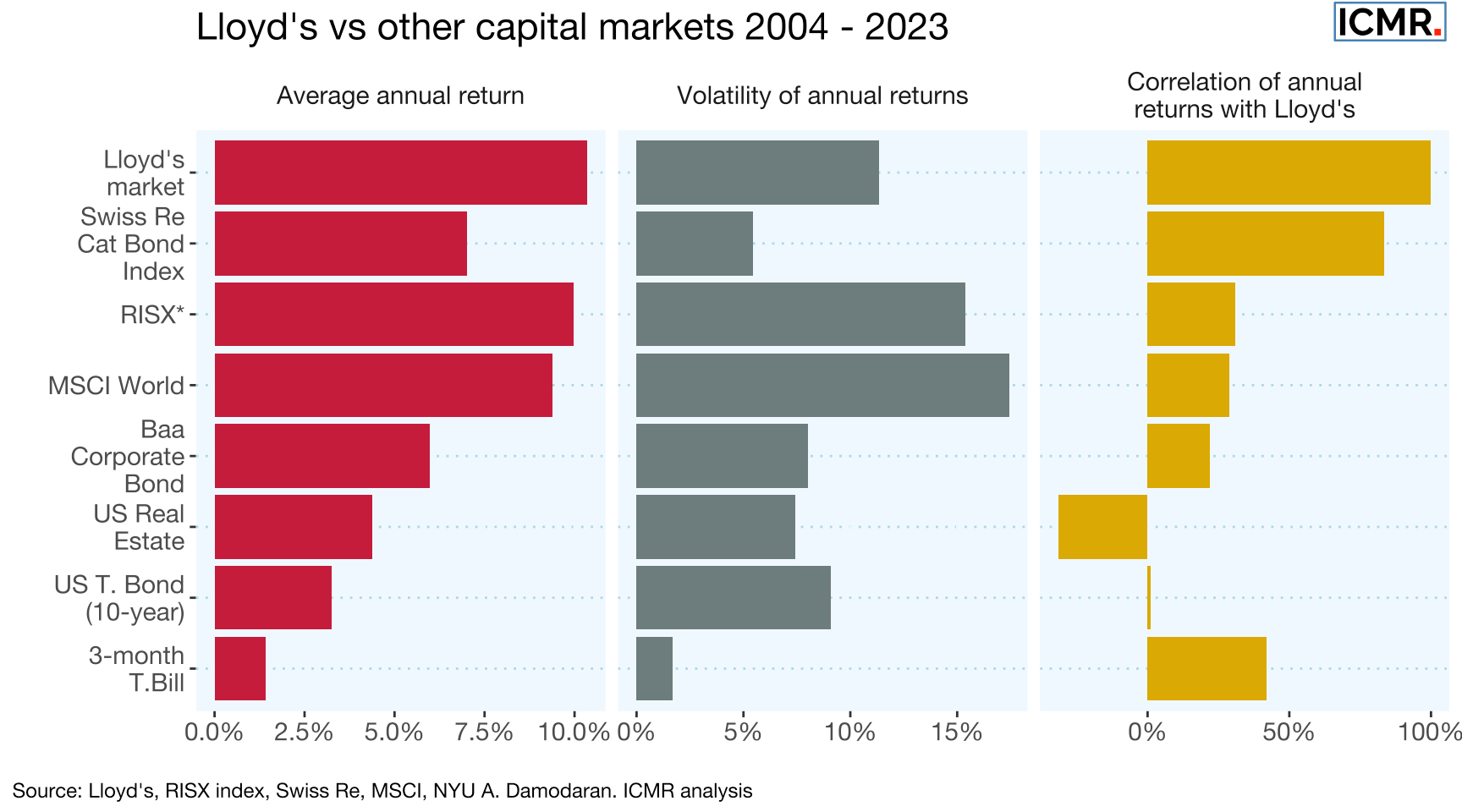

The full insights report, co-authored by LMA and ICMR, covers the overall performance of the market and conducts a detailed examination of individual syndicate performance. It explores the factors driving growth and profitability across syndicates of varying sizes and maturity levels, and analyses the risk-return profiles of major classes of business. Additionally, the report benchmarks the market's performance favourably against liquid specialty (re)insurance investments and catastrophe bond indices.

The highlights demonstrate that Lloyd’s as a market continues to offer an attractive return on capital over a twenty year period with a low correlation with other asset classes, represented for example by the MSCI World Equity Index.

Figure 1: Comparing Lloyd’s annual pro-forma returns on capital over 20 years against other investments. MSCI World is a market cap weighted equity of global stocks, RISX equity index data from 2007 onwards only.

At an individual syndicate level, almost all syndicates have made an underwriting profit in 2023. Given the extra costs and capital loadings applied to start up syndicates, the analysis shows that 2022/23 was clearly a good time to commence underwriting in Lloyd's. The 2023 league table of syndicates by pre-tax results highlights the consistent performers, but also that size alone is no guarantee of inclusion in the top 10.

Table 1: Rank of the top 10 most profitable syndicates over the last 5 financial years, excluding legacy writers.

The full insights report is available on the ICMR website here.